Stocks declined last week due to much higher volatility and trading volumes. Large-cap indexes performed better than mid- and small-cap shares. Wednesday, equities posted their worst day since October, with the S&P 500 falling almost 2.6%. Total trading volume hit a record high of 23 billion shares as well, and a huge jump from the YTD average daily volume of about 14 billion. European shares fell amid worries that the economy could slow due to the raging coronavirus pandemic and delays in the distribution of coronavirus vaccines. In local currency terms, STOXX Europe 600 Index ended the week 3.11% lower. Japan’s stock markets declined for the week. The Nikkei 225 Stock Average fell 3.4%.

Although we had a busy earnings week, whereby 37% of the S&P 500 was to post quarterly financial posts, all attention was focused around unusual fluctuations in the prices of “meme” stocks that are popular among retail investors, and caught most of the headline news. Encouraged by message boards on Reddit and other online forums, these investors seemed to collectively target stocks with high percentages of short interest through buying the shares. GameStop, a video game retailer, and movie theater operator AMC Entertainment Holdings were two of the heavily shorted stocks that experienced short squeezes, causing huge price gains and major losses on short positions. According to media reports, major hedge funds were among the short investors, and they sold out of other stock positions to cover their losses.

Amid the swings caused by short squeezes, the Federal Reserve’s January policy meeting took a back seat in terms of market focus. In the FOMC’s statement and in Jerome Powell’s post-meeting press conference on Wednesday, policymakers reinforced the message that the economic outlook remains uncertain and that it will be some time before the central bank begins to taper its asset purchases. The government also reported that overall economic growth slowed considerably in the fourth quarter. Gross domestic product (GDP) grew at an annualized rate of 4.0%.

Germany, France, and Spain reported relatively resilient GDP numbers for the fourth quarter, spurring hopes that the eurozone might avoid a deeper recession. The German economy expanded 0.1% sequentially, thanks to strength in exports and construction; Spain’s GDP unexpectedly grew 0.4%, driven, in part, by increased household consumption. France’s economy shrank 1.3% in the fourth quarter, an upside surprise relative to a consensus estimate that had called for a 4.1% contraction. Bright spots for the French economy in the fourth quarter included robust exports, steady business investment, and a rebound in consumer spending. However, due to continuing lockdowns, the German government cut its 2021 forecast for GDP growth to 3% from its previous estimate of 4.4%.

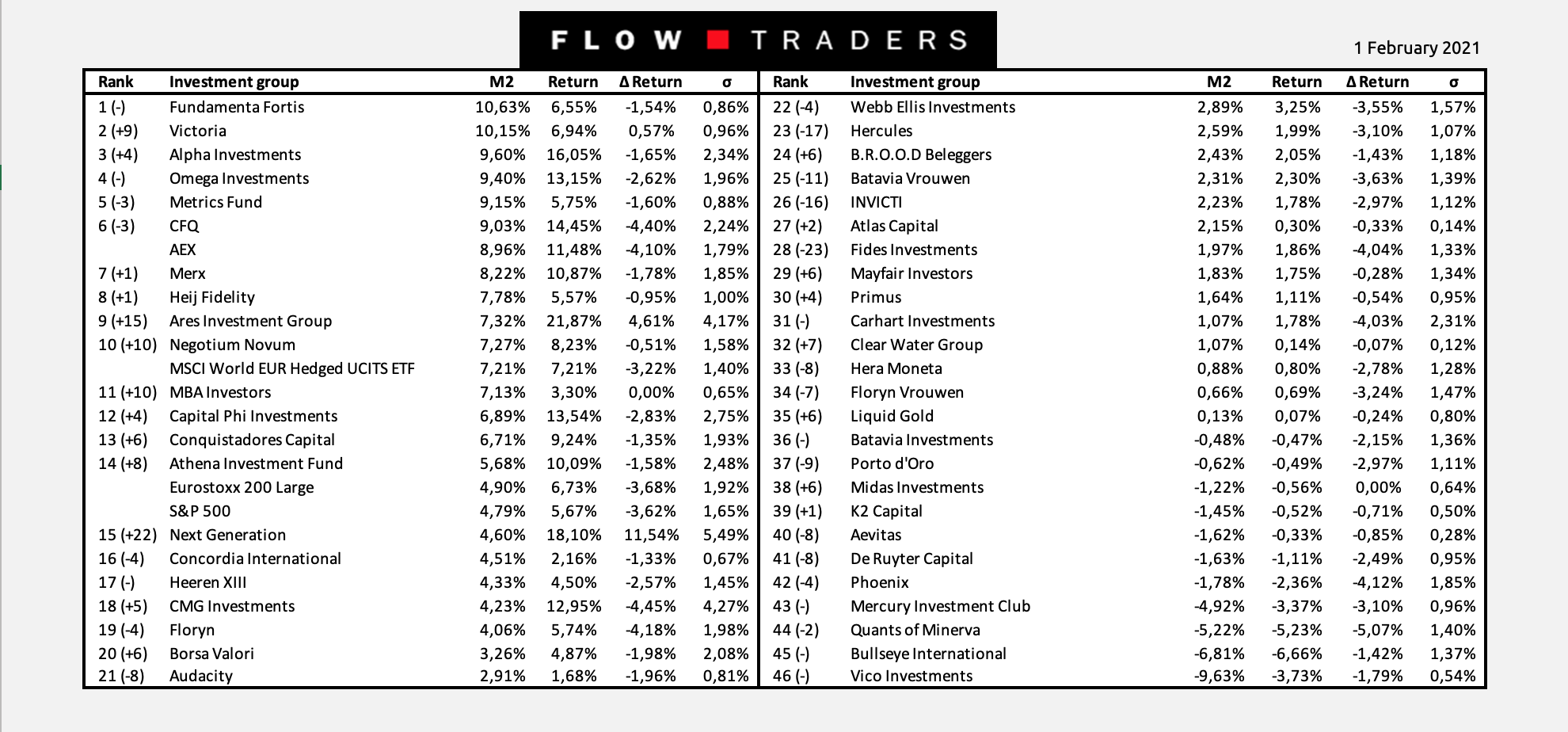

With regards to the Investment Competition, most groups had a negative return last week due to increased market volatility. Fundamenta Fortis is the top performer with an M^2 of 10,63%. Victoria is holding out firmly in second place with an M^2 of 10,15%. Next Generation takes the crown in terms of absolute return with 11,54%, also being the top riser this week. On the other hand, Fides Investments losts 23 spots in the rankings.

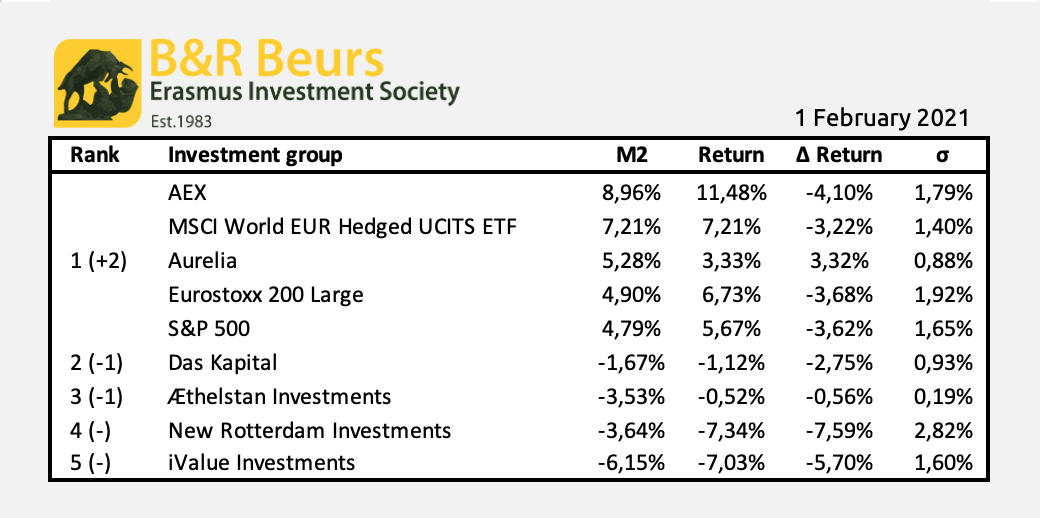

In the second Investment Competition, Aurelia has risen through the ranks and attained the number one spot in the competition with an M^2 of 5,28%. Weekly returns of all groups except Aurelia are unfortunately in the negative, with New Rotterdam Investments wiping out all their positive returns by losing 7,59% this week.