Welcome to this investment competition update. Week 18 was one of more earnings reports and great returns. The S&P 500 closed on a positive note closing 0.96% up from Monday, which is quite similar to the 0.86% return posted by the EURO STOXX 50. Let’s take a look at some of the headlines from during the week.

The week started with interesting news from the crypto markets. Ethereum broke through the barrier of $3000 for the first time on Monday. It has since continued its rally and traded around $3,900 on Sunday. But Ethereum was not the only cryptocurrency investors were talking about this week. Dogecoin, a crypto coin that started more or less as a joke, saw its value surge around 63% in a single day, only to tumble 46% just a few days later. The reason for the decline is likely to be Elon Musk calling the coin a “hustle” during his Saturday Night Live appearance.

Another interesting headline was Verizon agreeing to sell Yahoo and AOL to Apollo Global Management, a private equity firm, for $5 billion. The American telecom company initially acquired Yahoo to deliver digital advertising services but had to write-down the value of the acquired company as much as $5 billion in 2018 due to strong competition from Google and Facebook. The acquisition of the internet company is an interesting move, as the collapse of Yahoo’s value over time has been both stunning and unique. The price now paid is only a fraction of the $100+ billion valuation the company received during the dot-com mania.

The week concluded with big news surrounding the U.S. jobs report on Friday. The Labor Department reported only 266,000 jobs were added in April. This number fell way short of the 988,000 jobs estimated by economists. The unemployment rate in April increased from 6% to 6.1%, which was also worse than the 5.8% consensus. On top of that, the 916,000 jobs reported in March were revised down to 770,000. According to the DOL, the figures show the American Rescue plan is working, but there is still a “steep climb ahead”.

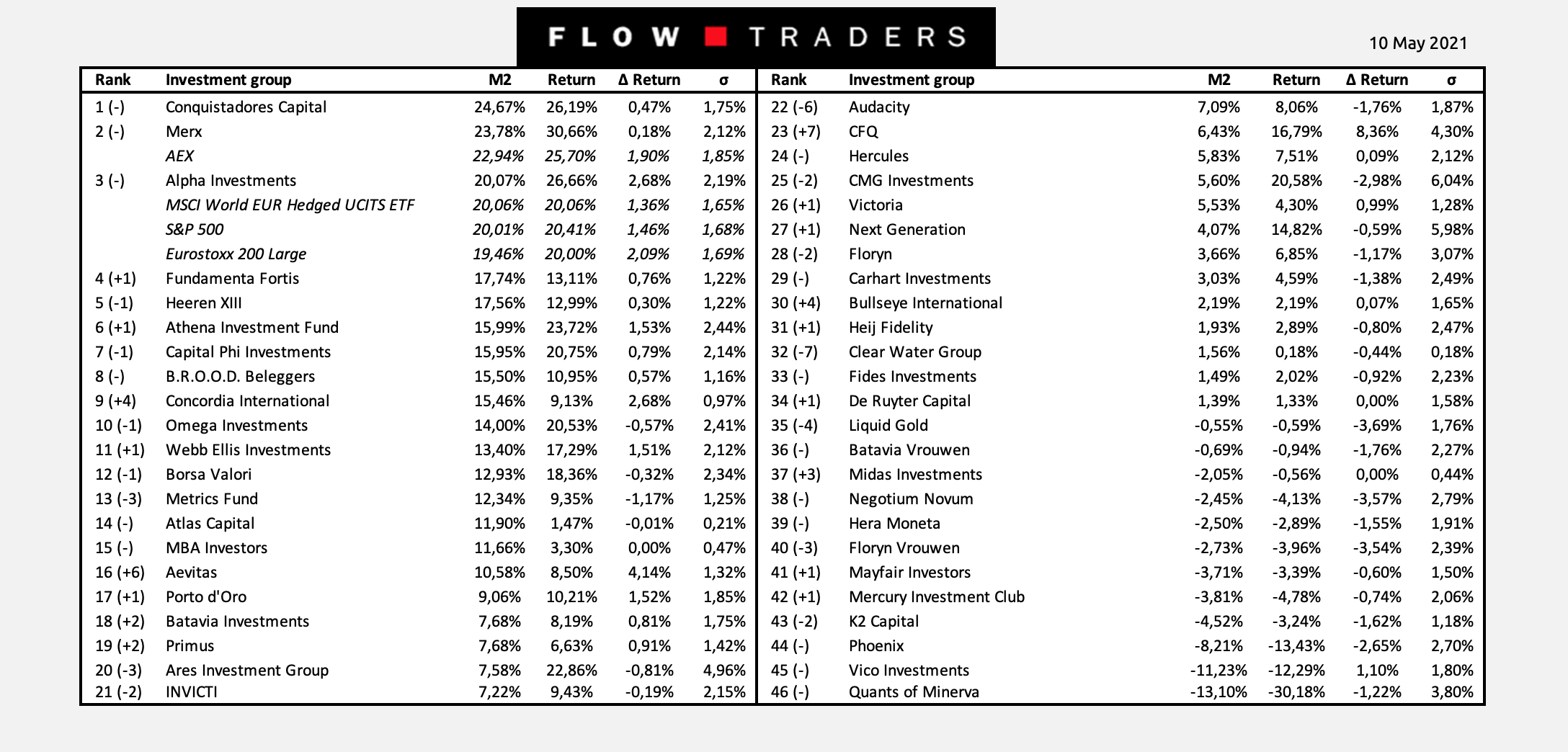

Let’s now turn to our very own Flow Traders Investment Competition where the rankings this week have been fairly stable. The top 3 remains the same with Conquistadores Capital still in the lead. The gaps between these teams remain small so a change in ranking could happen at any moment. CFQ managed to achieve an impressive 8.36% return and as a result, rose 7 spots in the rankings.

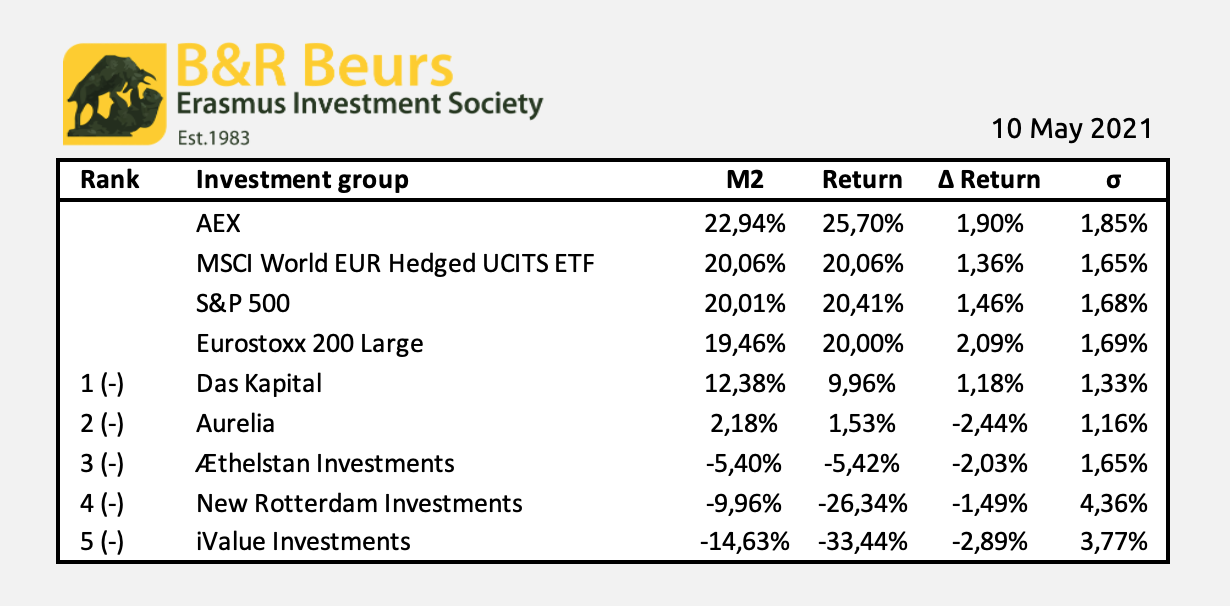

For the 5th week in a row, there are no changes in rankings to report on in the second B&R Beurs Investment Competition. Das Kapital is still on top and is quite far ahead of number two Aurelia. The number one also managed to pull off the highest weekly return at 1.18%, increasing its lead even further with all other teams reporting negative figures.