At first glance, the week began promisingly. The Dow Jones Industrial Average was up 0.3% and the Nasdaq rose 2%. The S&P500 gained 1.8%, marking an 8.1% increase in the past two weeks. As the week came to an end however, the major U.S. indices traded lower. On Friday, the Nasdaq decreased by 0.16%, S&P500 gained 0.51% and The Dow Jones gained 0.44%.

The escalating war in Ukraine and the Federal Reserve’s plans to combat inflation continue to weigh heavily on investor decisions. Following the Fed’s commencement of the monetary policy tightening campaign, yields jumped. The hawkish comments from Fed Chairman Jerome Powell amplified uncertainty. This led to a higher increase in short-and medium-term Treasury yields than longer-term bonds. On Thursday, the yield on the three-year note increased from 2.346% to 2.536%. Both the yields on five-and seven-year notes closed above 2.5%.

To decrease Europe’s dependence on Russian gas, President Biden announced that the U.S. will nearly double its shipment of liquefied natural gas to Europe. The agreement regards 50 billion cubic meters of liquefied natural gas annually, set until at least 2030. The market’s reaction led to a decrease in gas price from €133 euros to €100 euros per megawatt-hour. Germany also took measures to further diminish its vulnerable position. By the beginning of June, they aim to diminish their import of Russian oil by 50%. As for gas imports, it strives to minimize its dependency by mid-2024. This will most likely hurt Russia immensily because of the great dependency of Russia on foreign export of gas. Former Republican presidential nominee and long time senator of Arizona John McCain ones described Russia because of this fact as "A Gas Station Masquerading As A Country".

The Omicron-variant made room for recovery in the European economy in February. Currently, markets are focused on the war in Ukraine and its economic impact however economic indicators continue to show solid demand and activity. Most European equities finished higher, which could also be a result from the U.S. collaboration regarding gas import. Stoxx Europe 600 gained 0.11%, Germany’s DAX Index and FTSE100 gained 0.21%. AEX-Index gained 0.42%.

In Asia, the increase in energy and commodity prices led to mixed results. Japan's Nikkei 225 Index increased by 0.1%, however China's Shanghai Composite Index and Hong Kong's Hang Seng Index faced declines of 1.2%, and 2.5% respectively.

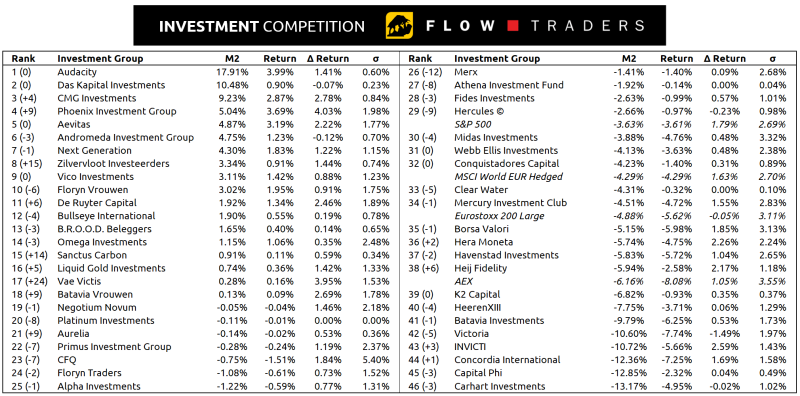

Competition

Audacity is keeping a strong hold on the first place with another impressive 1.41% weekly return. Das Kapital is also holding on to second place with several groups coming up from their rear. Let's hope for their sake that their investment strategy wasn’t written by Karl Marx. Another notable happening this week: for the first in time immemorial Merx was spotted on the right row of the competition dropping 12 places in an embarrassing, albeit uncharacteristic, fall from grace.