Indexes

This week, the S&P 500 fell on Friday due to a decline of 3.2% in Nvidia shares, however it still continued its three week streak of gains. Despite falling by 8.55 points on Friday, the S&P 500 index was up 0.6% for the week. The Dow Jones Industrial Average went up by 1.5% to 39,150.33 with an increase of 15.57 points. The Nasdaq Composite on the other hand ended the week with almost no change of 17,689.36 points. The STOXX Europe 600 Index ended the week with a 0.79% increase as signals for monetary policy easing became clearer, despite recent political uncertainties. Overall there was also an increase in major indexes across Europe. In Germany, the DAX gained 0.90%, France’s CAC 40 Index increased by 1.67%, and FTSE MIB in Italy rose by 1.97%. The picture was no different in the UK as the FTSE 100 Index gained 1.12%. Additionally this week, the Bank of England has decided to keep the interest rates unchanged as the inflation has started to slow down to the target. The Swiss National Bank on the other hand decided to cut interest rates once again, while Norway’s Central Bank decided to keep it unchanged. In Asia, stock markets did not perform as well as in the West, with many indexes in Japan and China ending the week with losses.

Cryptocurrency

The crypto market had a shaky start to the week. Starting on Tuesday evening (18/06/2024), within 12 hours, Bitcoin fell to a monthly low of $64,000. As a result, the money that left the crypto markets reached over $100 billion at some point. The fall continued on Friday as Bitcoin fell below $64,000, reaching its lowest position in more than five weeks. Ethereum also had a week of declines. It hit its weekly low of $3,371.59 on Tuesday and even though it had gains throughout the week it is currently (22/06/2024) standing at $3,496.19, with a 1.7% fall over the past week. Dogecoin, Toncoin, Cardano, and Solana also faced falls of up to almost 10% this past week.

Bonds & Exchange rates

The US dollar slightly strengthened against the euro as the EUR/USD exchange rate fell by 0.09%, closing the week at $1.0695. On the other hand, the euro strengthened against the British pound and Japanese yen by 0.23% and 1.40%, respectively, closing the week at £0.8458 and ¥170.80. The yield of the 10-year U.S. Treasury bond increased by 2.90% this week, closing at 4.257%. Meanwhile, the 10-year bond yields in other countries closed at the following rates: Germany at 2.412%, the UK at 4.088%, France at 3.147%, and China at 2.305%.

Commodities

This past week, there was a decline of 2.55 million barrels in US commercial crude oil inventories due to increased exports. Gasoline and distillate stocks also fell by 2.28 million barrels and 1.73 million barrels, respectively. Oil prices continued to increase, and European natural gas prices remained volatile.

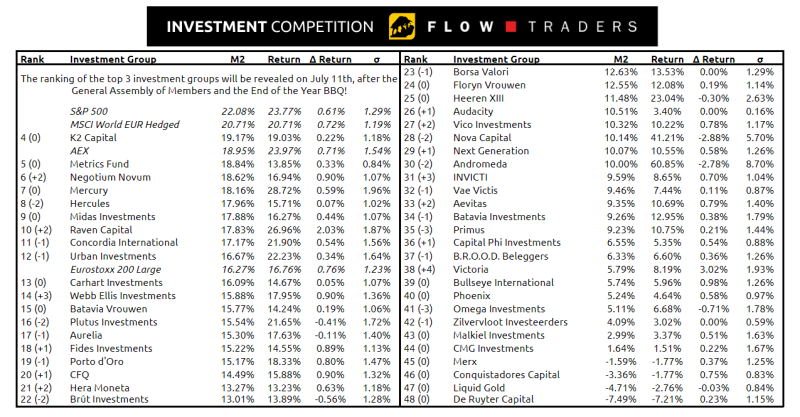

Flow Traders Investment Competition

For the last 3 weeks of this year's Flow Traders Investment Competition the top 3 will be hidden again, till the winner will be announced on July 11th. Last week, Victoria climbed 4 spots by having a return of 3.02% in just one week. Furthermore, De Ruyter Capital is still in last place, can they still prevent themselves from finishing last in the competition?