Market Overview

Despite the shortened week, the markets have not seen a calm couple of days, as incoming US

payroll data gives investors hope for a rate cut sooner rather than later.

US Indices and economic data

Over the course of last week, most of the major US indices rose slightly - the S&P 500

increased by 1.43%, reaching 5567, while the Dow Jones Index nudged 0.53% upwards

arriving at 39575. The tech-heavy Nasdaq index rose 2.9%, as many of the mega-cap tech

stocks posted gains for the week. The biggest winner was Tesla, as the EV maker's stock

rallied over 26% after it reported upbeat delivery numbers.

New data released this week suggests that the US economy has started to cool down. In June

the labor market started to ease, adding 206000 new jobs, which indicates a decline from the

218000 in May. The unemployment rate, on the other hand, came in higher than expected at

4.1%, crossing above 4% for the first time in two years. These numbers could indicate that in

line with the economy, inflation will also cool in the coming months, signaling the possibility

of a rate cut to the Fed.

Commodities

In the realm of commodities, gold and silver prices have been steadily increasing over the last

week, posting gains of 3 and 7 percent, respectively. Both metals have been doing well lately

with gold almost erasing its slight decline over the last couple of weeks and silver

approaching an 11-year high, currently standing at 31.5. Meanwhile, crude oil prices hold

steady at around 86 USD per barrel.

Crypto

Investors of crypto continue to receive bad news, as just this week alone, the crypto market

lost 200 billion of its total capitalization. Much of this downside has been attributed to

Bitcoin, down by a further 5% this week, currently standing around 57650. Many other

popular cryptocurrencies, such as Ethereum, Solana, and BNB also reported a decline.

Flow Traders Investment Competition

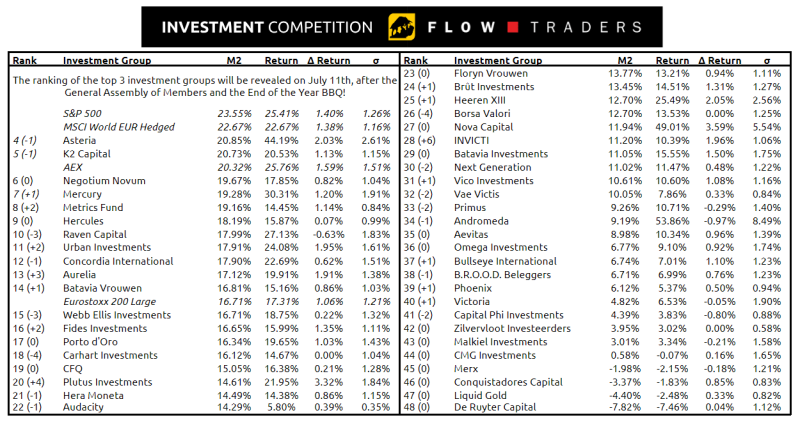

The 2023-2024 Flow Traders Investment Competition has ended. After a year with great returns on the stock markets almost all Investment Groups have ended with a positive return. A honourable mention for the groups that have ended in the competitions' top 10: newcomer Asteria, K2 Capital, Negotium Novum, last years' winner Mercury, Metrics Fund, Hercules and newcomer Raven Capital. Furthermore, a special mention for the groups that finished with the highest returns: Andromeda, Nova Capital and Asteria. However, for De Ruyter Capital it's been a year to forget, after finishing in last place. Well... the only way is up from here!

On Thursday the winner of the 2023-2024 Flow Traders Investment Competition will be announced. Will it be Floryn Traders, Heij Fidelity or Midas Investments? The announcement will be at the social drink at Apartt on the 11th of July around 21:30!