Market Overview Week 5

U.S. equities and indices:

The S&P 500 closed on Friday at 6,040.53, seeing a 1% decline across the week.The Dow Jones Industrial Average also saw an 0.3% jump, closing on Friday at 44,544.66 after a high of 44,882.13 on Thursday. NASDAQ saw a big decline on Monday with the waves caused by the Chinese AI DeepSeek, and dropped 1.6% overall in the last week but recovered to 19,627.44 by Friday.

There was a major stir in the tech space earlier last week, caused by the introduction of DeepSeek, showing comparable and even better performance than current major AI models, causing major concerns about competition incoming from China in the AI space.

Commodities:

Gold futures closed at 2,835 USD, up from last week, and Silver has also been up, closing at 32.265 USD. Crude Oil and Natural gas on the other hand have both been down since last week, closing at 72.53 and 3.044 USD respectively.

Cryptocurrency:

President Trump has proposed the U.S. having cryptocurrency reserves by creating a “Strategic National Bitcoin stockpile” worth 21 million USD, with the intention of making the U.S. lead the digital assets space.

Competition Update 03-02-2025, 9:00 AM

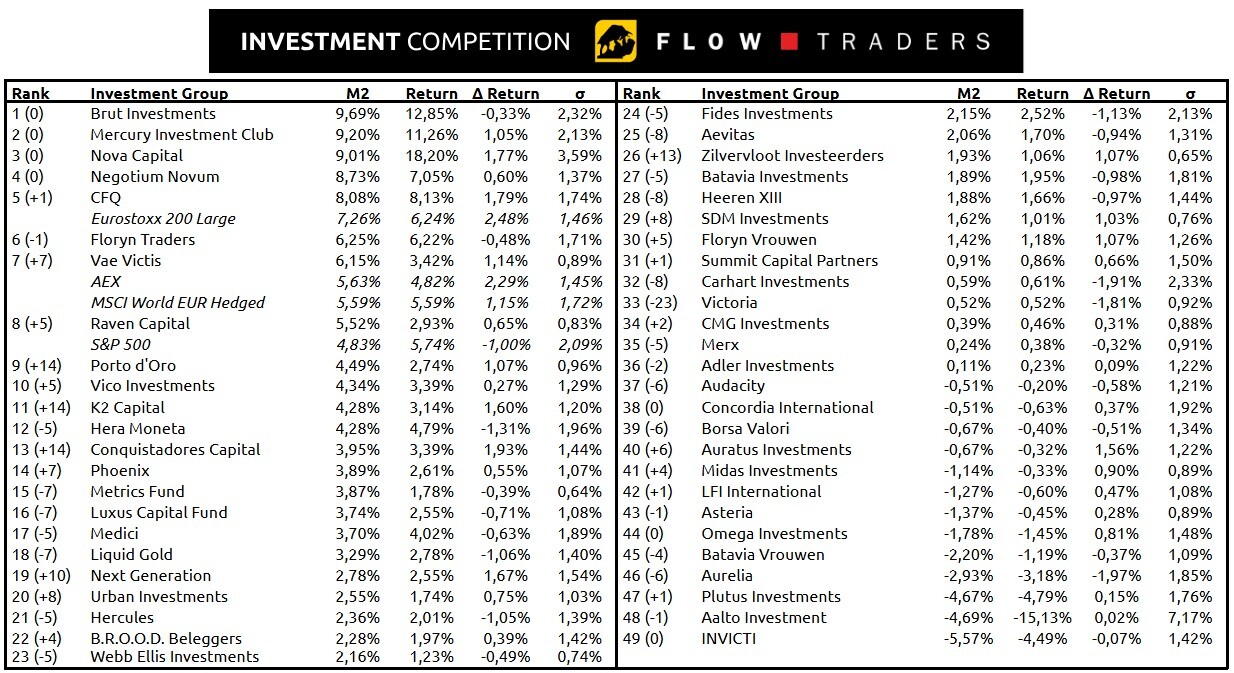

January has come to a close, and Brût Investments continues to hold the top spot, despite a slight dip in return. Mercury Investment Club remains hot on their heels, gaining over 1% this week, while Nova Capital stays steady in third.

This week saw increased market volatility, with semiconductor stocks impacted by Deepseek and Trump’s newly imposed import tariffs. As a result, several investment groups faced challenges, while others capitalized on the market shifts. Porto d’Oro and Vae Victis made impressive climbs, while Victoria suffered the biggest drop, falling 23 places.