Market Overview

This week markets were driven by a combination of earnings reports, key macroeconomic developments and geopolitical tensions. President Trump's announcement of a “reciprocal tariff” policy rekindled trade war concerns, while key economic data releases added to volatility in various asset classes. Below is a recap of last week's developments:

U.S. Equities & Indices

U.S. equities experienced modest gains, with tech stocks leading the charge. S&P 500 climbed 0.94%, closing at 6,025.99, while Dow Jones Industrial Average inched up by 0.08% to finish at 44,303.40. Nasdaq outperformed both, climbing 1.60% to close at 19,523.40.

The "Magnificent Seven" had mixed results, ultimately posting a slightly negative performance. Meta and NVIDIA were the exceptions, recording gains amid broader sector volatility. NVIDIA and Broadcom shares rose mid-week after Alphabet, the parent company of Google and an important customer of both chipmakers, announced plans to increase its investment in artificial intelligence. Meta shares also rose slightly in after-hours trading on Wednesday as the company reported fourth-quarter results that beat expectations on both revenue and profit.

Magnificent Seven Performance:

-

Apple: $227.63 (-1.15%)

-

Amazon: $229.15 (-1.96%)

-

Microsoft: $409.75 (-0.43%)

-

Alphabet: $185.34 (-3.27%)

-

Meta: $714.52 (+0.36%)

-

Tesla: $361.62 (-3.39%)

-

Nvidia: $129.84 (+0.90%)

Global markets

Global markets closed with mixed results this week. In Asia, Japan’s Nikkei 225 declined 0.37%, finishing at 38,787.02, while Hong Kong’s Hang Seng Index rose 5.41% to 21,133.54. China’s Shanghai Composite gained 2.51%, closing at 3,303.63.

In Europe, the Euronext 100 increased 1.99% to 1,113.00, and Germany’s DAX climbed 2.28% to 21,787.00. The UK’s FTSE 100 recorded a modest rise of 0.31%, closing at 8,700.53.

Commodities

Commodity markets saw notable movements this week. Brent crude oil fell by 2.19% to settle at $74.70 per barrel. Gold (XAU/USD) rose 2.10% to close at $2,861.25, while silver (XAG/USD) was relatively flat, down 0.07% at $31.78.

President Trump is expected to announce tariffs on aluminium and steel on Monday, which could have a significant impact on commodity prices in the coming weeks.

Crypto

Amid growing concerns over inflation and the potential impact of new tariffs, cryptocurrency markets saw declines this week. Bitcoin (BTCUSD) fell 1.87% to close at $95,930.26, while Ethereum (ETHUSD) fell 8.70% to $2,598.55.

Critical Market Events to Watch (Week of 10.02 - 14.02)

-

Monday: Trump’s "Reciprocal Tariff" Announcement

-

Tuesday/Wednesday: Fed Chair Powell Speaks

-

Wednesday: January CPI Inflation Data

-

Thursday: January PPI Inflation Data

-

Friday: January Retail Sales Data

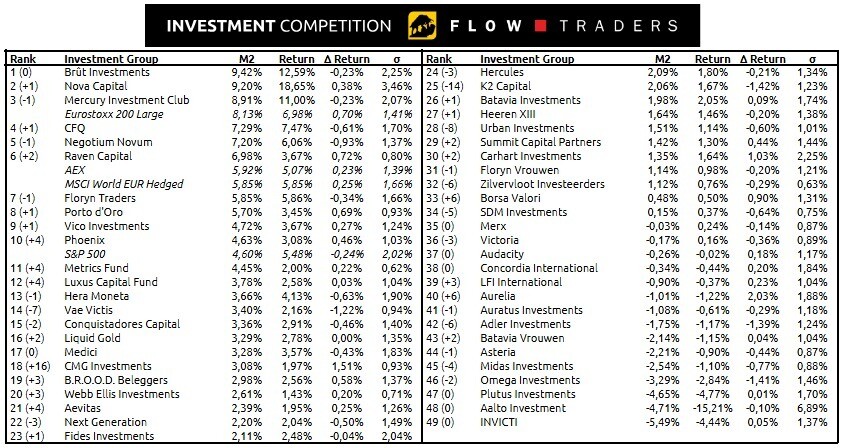

Competition Update 10-02-2025, 9:00 AM

The first full week of February brought relatively minor shifts, with most investment groups seeing changes of less than 0.5%. However, Nova Capital managed to overtake Mercury Investment Club for second place, further cementing their position among the leaders. Meanwhile, CMG Investments made a remarkable leap, moving up significantly thanks to an outstanding delta return of 1.51%. Will they be able to sustain this momentum, or was this just a one-time lucky shot?

Looking to deepen your understanding of what moves a stock and how to hedge your positions? Don’t miss our Professional Academy by Point72 this Thursday! Sebastiaan Smits, quantitative researcher and former B&R member, will provide insights into hedge funds and lead an interactive session on market dynamics and strategic positioning.