Market Overview

Stocks ended the week with mixed results, closing lower on Wall Street and higher in Europe. Investor sentiment was shaped by US President Donald Trump's proposed policy actions, including spending cuts and tariffs, as well as uncertainty over Germany's upcoming elections.

Since returning to the White House last month, Trump has imposed tariffs on several key US trading partners and launched an initiative to significantly reduce the federal workforce, which currently stands at 2.3 million employees. These moves have fuelled both market volatility and discussions about their long-term economic impact.

U.S. Equities & Indices

Overall the market had a bearish outlook this week U.S. equities experienced decrease. The Dow dropped 2.89% to 43,428.02, the S&P 500 fell 1.67% to 6,013.13 and the Nasdaq Composite slid 2.17% to 19,524.01.

The Magnificent Seven stocks delivered mixed results this week, with most posting negative results. Apple and Microsoft were the exceptions, reporting gains amid market volatility.

Apple's shares rose following the release of the iPhone 16e, while Microsoft introduced the world's first quantum chip powered by its new Topological Core architecture. The company claims this breakthrough will enable quantum computers to address industrial-scale problems within years rather than decades.

Magnificent Seven Performance:

-

Apple: $245.55 (+1.80%)

-

Amazon: $216.58 (-5.51%)

-

Microsoft: $408.29 (+0.14%)

-

Alphabet: $181.58 (-2.79%)

-

Meta: $683.55 (-5.87%)

-

Tesla: $337.80 (-6.32%)

-

Nvidia: $134.40 (-1.46%)

Global markets

European markets move around the German federal election, showing declining value. On the other side of the ocean, in Asia, the Nikkei index dropped. Once again Us President Donald Trump’s tariffs and pressuring comments drove down the price.

Commodities

Oil prices have fallen on Friday, resulting in a weekly decline of the crude oil market level. The downward movement can be attributed to uncertainty about a peace deal in Ukraine.

Precious metals indexes remained fairly stable over the past week, showing minor volatility.

Crypto

Bitcoin index values show a slight decrease, falling to 91.5k as the weekend starts. Investors show scepticism towards the crypto asset, as expectations for a accelerating decrease in Bitcoin value rise.

Critical Market Events to Watch (Week of 24.02 - 2.03)

-

Tuesday: S&P/Case-Shiller U.S. National Home Price Index, Conference Board Consumer Confidence Index

-

Wednesday: U.S. New Home Sales Report

-

Thursday: U.S. Gross Domestic Product (Q4 GDP), Weekly Initial Jobless Claims, Pending Home Sales Report

-

Friday: Core Personal Consumption Expenditures (PCE) Price Index, Chicago Purchasing Managers’ Index (PMI)

Earnings Calendar:

This week also features highly anticipated corporate earnings, including those from NVDIA and Rocket Lab, which could impact market sentiment.

-

Monday: Domino’s Pizza ($DPZ), Tempus AI ($TEM), Zoom Video ($ZM), Hims & Hers ($HIMS)

-

Tuesday: Home Depot ($HD), CAVA Group ($CAVA), AMC Entertainment ($AMC), Axon ($AXON), Lucid Motors ($LCID), Intuit ($INTU)

-

Wednesday: Lowe’s ($LOW), Nvidia ($NVDA), Snowflake ($SNOW), Salesforce ($CRM), Joby Aviation ($JOBY), IonQ ($IONQ)

-

Thursday: Rocket Lab ($RKLB), Clover Health ($CLOV), Dell Technologies ($DELL), Archer Aviation ($ACHR), Vast ($VST)

-

Friday: FuboTV ($FUBO), AES Corporation ($AES), AppLovin ($APP)

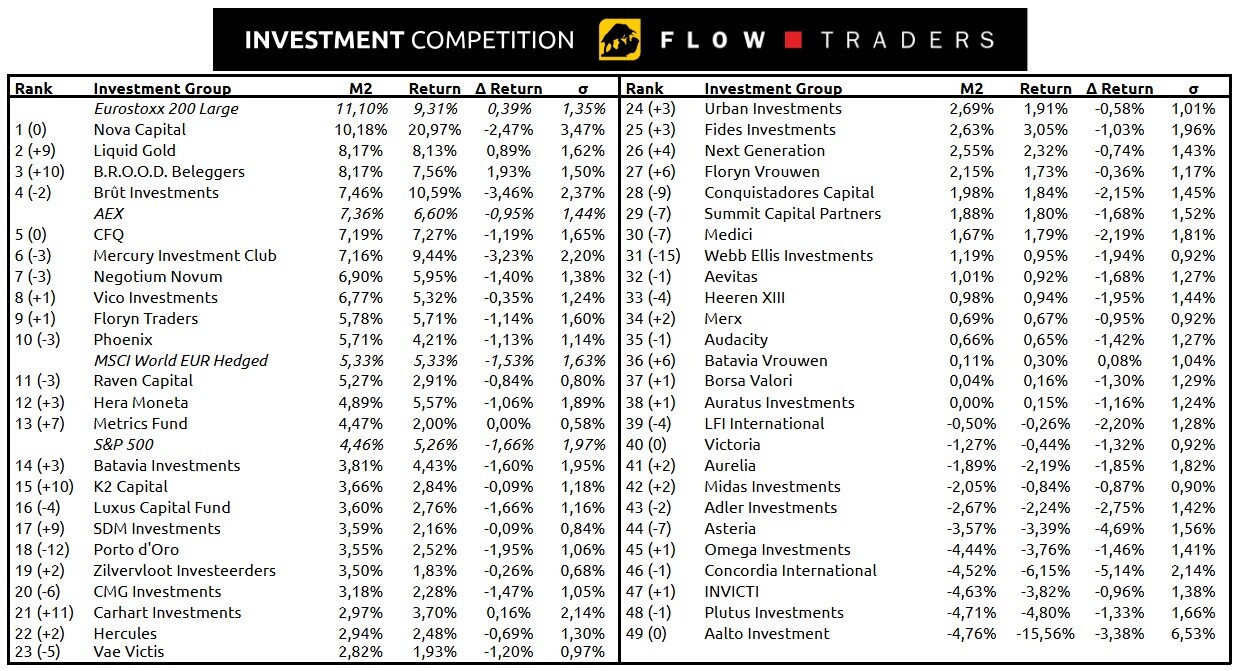

Competition Update

A shake-up at the top this week! B.R.O.O.D. Beleggers and Liquid Gold surged into the top three, finding steady returns in a week dominated by negative performances. This pushes Brût Investments and Mercury Investment Club down the rankings, both suffering their worst week yet with losses over 3%.