Market Overview

Markets came under significant pressure this week as renewed trade tensions fuelled fears of a global recession. US stock futures extended losses after the Trump administration reaffirmed its tariff stance, prompting retaliation from China and expected countermeasures from the EU. The impact was widespread, with bank stocks falling, oil prices hitting four-year lows and companies heavily exposed to China, such as Apple, facing increased risks.

In Europe, the economic outlook has worsened amid growing political uncertainty. The Eurozone remains particularly vulnerable to concerns that rising trade tensions could exacerbate existing structural weaknesses. Policymakers are closely monitoring the potential impact on inflation and growth.

Underlining increased risk aversion and market fragility, hedge funds experienced the largest margin calls since 2020 as declining asset values forced Wall Street banks to demand additional collateral.

U.S. Equities & Indices

US stocks fell last week as heightened trade tensions between the US and China increased the likelihood of a long-term global slowdown. The S&P 500 fell 8.21%, its worst weekly performance since March 2020. The Dow and Nasdaq fell 7.41% and 8.55% respectively, officially entering bear market territory.

Magnificent Seven

The Magnificent Seven tech giants, which generate almost half of their revenue from international markets, were among the most affected. Nvidia lost 10.3%, Tesla 3.91% and Apple more than 13%. According to Goldman Sachs, Amazon, which fell 9.11% this week, could face an annual profit loss of up to $10bn due to higher first-party product costs caused by tariffs.

Global Markets

The sell-off wave spread across the globe. FTSE 100 fell by 10.23%, while Germany's DAX and France's CAC 40 indices lost 11.44% and 11.04%, respectively. Asian markets also fell sharply, with Japan's Nikkei 225 index dropping 13.42% and China's Shanghai Composite Index falling 7.32%.

Global stock losses deepened after China responded to the US tariffs with a 34% import duty on US goods, mining export controls and new restrictions on American firms. Although other countries, including Vietnam and Cambodia, have signalled their willingness to negotiate, uncertainty remains high.

Some resistance was seen in US stocks related to housing, which investors thought could benefit from low interest rates in a risk-averse environment.

Commodities

Gold prices fell to a three-week low as investors liquidated positions to cover broader losses and margin calls. Spot gold fell 3% on Friday and hovered around $3,028/oz on Monday morning.

Brent crude oil fell nearly 13.78%, reflecting growing concerns over global demand. Meanwhile, silver rebounded to $30.22/oz, with platinum and palladium also posting modest gains.

Cryptocurrencies

Bitcoin fell 6.29% to around $77,228.57, below the $80,000.00 level, as it followed the broader decline in technology and risk assets. Other major cryptocurrencies, including Ether and Solana, suffered heavier losses.

This week’s Economic Agenda

For the week starting April 7, 2025, several key economic events are poised to influence financial markets:

-

Monday: Eurozone Retail Sales (February)

-

Tuesday: NFIB Small Business Optimism Index (March)

-

Wednesday: FED FOMC Minutes

-

Thursday: Consumer Price Index (CPI) (March) - Initial Jobless Claims

-

Friday: Producer Price Index (PPI) (March) - University of Michigan Consumer Sentiment Index (April - Preliminary)

Competition Update

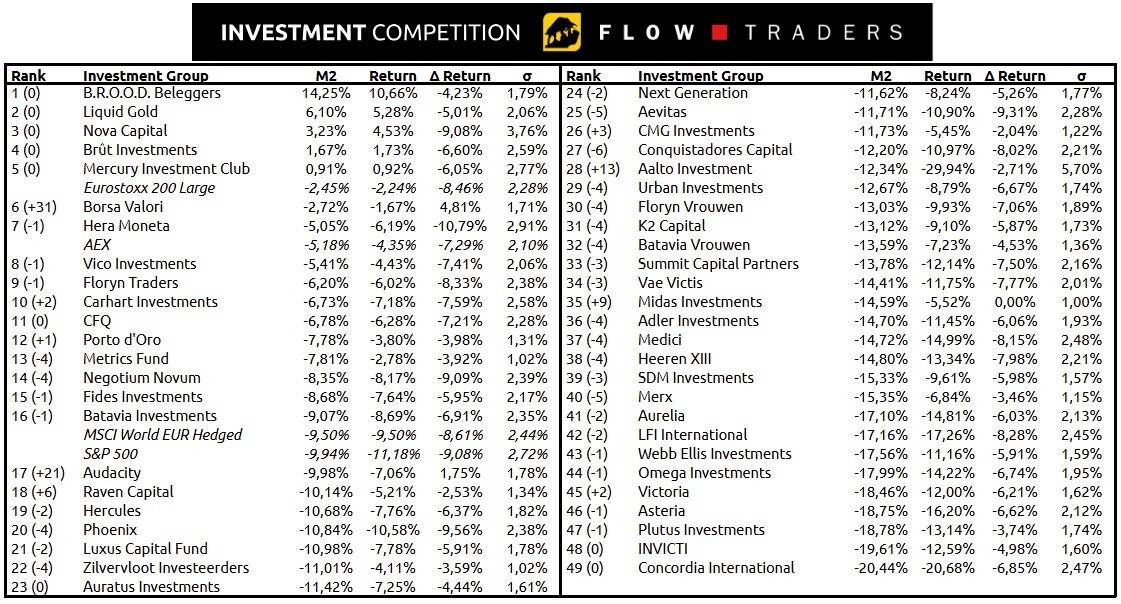

Trump’s so-called “Liberation Day” caused a wave of uncertainty across global markets this week, resulting in losses we haven’t seen in a long time. Almost all investment groups (and the indices) shed multiple percentage points as volatility took center stage.

But amid the chaos, two groups stood tall: Borsa Valori and Audacity. They were the only ones to truly capitalize on the downturn, rocketing up the rankings by an incredible 31(!) and 21 places, respectively.

With Eastern powers already reacting and the EU still locked in debate on how to respond, we’re eagerly awaiting the next developments; will this escalate further or soon stabilize? In times like these, carefully choosing your position is more crucial than ever. We’ll soon find out which groups read the signs correctly. Good luck to all in the weeks ahead!