Esteban Aguilar

22/12/2025

Introduction

Buy Now, Pay Later (BNPL) is often described as a “fintech revolution,” yet the idea behind it is far from new. The concept of spreading payments over time dates back to the late 19th century, when Singer Sewing Machines introduced one of the first widely adopted installment plans in the 1840s. Customers could purchase a sewing machine with a small down payment and then repay the remainder in weekly installments. Whilst the motivation behind this may have been from a marketing perspective, it laid the groundwork for modern consumer credit. Over the next century, this model evolved into department-store installment plans and eventually into the credit card, which institutionalised the idea of buy now, pay later for the mass market. Whilst credit cards are not formally classified as BNPL, they operate on the same core principle: consumption made possible through deferred payments.

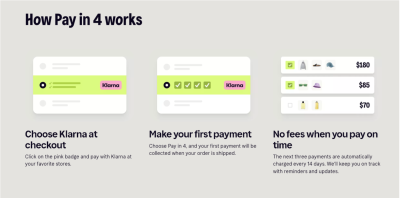

What has changed in the last decade is not the concept, but the technology and user experience. A new generation of fintech companies like Klarna, Afterpay, Affirm, and PayPal have re-engineered this concept into a frictionless and embedded payment option that appears at checkout with a single click. BNPL works as a short–term loan that lets users pay for products in small payments over a set period of time. Klarna, for example, gives the user the choice of splitting your payment into three or four smaller payments. However, unlike other types of loans, BNPL loans are typically interest-free and rarely carry other service fees (Udavant, 2025). The use of BNPL is not restricted to online payments; users can pay with Klarna using Apple or Google Pay in physical stores too. This convenience is particularly attractive for individuals on a tight budget or those making larger one-off payments on items like phones or computers. For example, an individual who would only receive their paycheck next week is now able to pay for groceries today without accruing interest by using Klarna. Providers of BNPL services argue that BNPL “democratises credit” by offering interest-free instalments and bypassing the traditional barriers of credit card approval processes.

This frictionless design has helped fuel explosive growth in the BNPL market. The value of BNPL is reported to have grown from 2,2 billion USD to 342 billion USD from 2014 to 2024 (YahooFinance, 2025). Furthermore, it’s expected that it will have reached a value of 560 billion in 2025, with further projections suggesting it could grow to around 912 billion in 2030 (Martino et al.). A major driver behind this expansion is the rapid shift toward digital shopping: as more purchases take place online, BNPL providers have secured deep integrations with e-commerce platforms, allowing their instalment options to appear directly at checkout. This seamless visibility, combined with the promise of interest-free payment plans, makes BNPL one of the easiest and most accessible forms of short-term credit available. Importantly, this convenience has been particularly appealing to younger consumers, who are both heavy users of online retail and less likely to rely on traditional credit products. According to a Morgan Stanley survey, BNPL adoption is highest among those aged 16–24 (41%) and 25–34 (39%), far exceeding usage among older age groups (Morgan Stanley, 2025). However, the rapid growth of the BNPL market has also started to raise concerns about the sustainability of such payment schemes. Specifically, there are concerns that BNPL encourages users to spend more than they have, thereby accumulating debt they simply can not pay off. Behind the promise of interest-free debt, there are substantial costs that accumulate quickly when one is not able to meet the repayment obligations. The fear is that younger users, who are the biggest adopters, fall prey to not understanding the gravity of the consequences.

Consumer Risks

To better understand the risks of BNPL payment schemes, it is important to consider why these services are so attractive in the first place. The convenience of easy access to credit is a big determinant, particularly when it’s presented as an interest-free loan, unlike conventional credit cards. This contributes to building an illusion of affordability. This illusion is further compounded by present bias and mental accounting, whereby future split payments feel smaller than paying the same amount at once. Consider an individual looking to buy a new phone online for 600€ but only has 300€ in their account. At checkout, the user is presented with an option to buy this phone now by paying three monthly installments of 200€ that are interest-free by a BNPL service provider. At the click of a button, they are able to receive the phone despite not currently having the funds for it. Present bias and mental accounting make it such that the three monthly payments of 200€ seem cheaper than paying 600€ now (which they don’t have in the first place). If this is a one-off purchase, and the user receives a somewhat stable income, this would not be considered all that risky. However, the real risk lies in how easy and tempting it is for individuals to opt for BNPL when given the chance.

The severity is highlighted in the aforementioned Morgan Stanley survey, where it is reported that the three most common categories of items purchased using BNPL are: clothing, electronics, and groceries (Morgan Stanley, 2025). BNPL schemes can genuinely prove beneficial for those looking to make larger one-off transactions on items like electronics, who simply don’t have the funds now (assuming they will have enough to make the monthly installments). In this case, it is fairly easy to understand that every month, 200€ will be spent on these monthly installments. However, it becomes significantly more difficult to account for monthly expenses on installments if an individual has opted for 15 different BNPL payment schemes. This could very much be the case if someone were to opt for BNPL every time they bought groceries throughout the month. The benefit of easy credit access quickly amounts to complicated and messy debt obligations when one-off BNPL purchases morph into everyday transactions. In essence, BNPL schemes bring rise to behavioural biases that underscore the amount an individual is spending as smaller future payments are discounted more than one-off payments, even if they amount to the same value. This complication is worsened by the ease of access to BNPL schemes, as one-off transactions quickly become everyday transactions, making it all the more difficult for users to understand how much they have spent and will soon owe.

One might wonder how these providers are generating any revenue if they are issuing interest-free loans. This is where things take a turn for the worse, particularly for those who rely on these schemes for frequent transactions. Whilst advertisements claim there are no fees or interest, there are cases where fees become applicable. For one, it is possible that a fee will be charged if a retailer is not affiliated with the provider directly. For example, in early 2024, Klarna would charge transaction fees up to 2$ for retailers like Target or Kroger (Lopatto, 2024). Though this is likely less applicable now, as BNPL providers have become increasingly integrated in the retail space. The fees associated with late payments are a bit more complicated to understand. On the Klarna website, they have published the Pay in 4 Agreement, which claims “A Late Fee of up to $7 may be charged if any scheduled payment remains unpaid after 10 days (the total of late fees charged on an order will never exceed 25% of your Total Purchase Amount)” (Klarna, 2025). Again, this amount does not seem all that bad, but it does become more problematic when a user has many active debts that they start to fall behind on. Another thing to consider is that it is possible to have several BNPL accounts. It is technically not against the rules to have accounts open with several different providers. Additionally, depending on the provider, it is possible to open several accounts with different emails (Medine, 2023). In the event that someone can no longer repay the loan at all, the lender may freeze the account to stop further purchases, and the debt could be turned over to a debt collector (CFPB, 2024). Finally, to make matters worse, a study by RFI Global reports that only half of BNPL users are aware of late payment fees (2025). They also report that 15% have already incurred late fees, with the amount being as high as 22% for those with ‘poor’ or ‘very poor’ credit scores.

The risks of taking on too much debt at the click of a button is not unique to BNPL services; individuals who hold credit cards also have this option. However, there are two key differences that could make BNPL more risky than credit cards for users. Firstly, it is harder to set up a credit card than a BNPL account in the first place. Some banks may require approval before being issued a credit card, for example. Setting up a BNPL account is as easy as creating an account linked to your bank account, and it is also possible to have several active BNPL accounts. Secondly, BNPL providers commonly advertise their services as free of interest and fees, which is misleading, as there are fees when payments are late that quickly accumulate. The difference is that there is a misconception that BNPL schemes are significantly cheaper than credit cards, as that is what has been advertised.

Macroeconomic Risks

In addition to personal risks for users, there could be some concerns that the popularity of BNPL could pose a risk to the broader economy. One big concern is the regulatory blind spots, an aspect that has helped BNPL schemes achieve such high growth. Namely, BNPL providers rarely conduct credit assessments. Though the bigger issue is that the credit behaviour of BNPL users is not entirely visible to creditors. In the US, credit scores are a very useful indicator of credit behaviour by considering the number of up-to-date payments, history of negative debts, and financial relationships with companies. Creditors rely on these metrics to assess the creditworthiness of the counterparty before issuing a loan. The issue is that for creditors, the only observable behaviour for BNPL users is whether or not someone has defaulted. This no longer paints the full picture and forms a sort of shadow credit, which introduces a degree of informational asymmetry that could distort credit markets. You may recall from introductory economic courses that when insurance providers face information asymmetry, it becomes optimal for them to charge higher premiums. In the context of credit markets, it would imply that creditors would start charging higher rates across the board. Whilst justifiable for BNPL users with poor credit behaviour, it would come at the expense of responsible users being unfairly charged a higher rate.

Another risk BNPL schemes could pose to the broader economy is related to the degree of retail dependency on such payment programs. The growth of e-commerce and BNPL are fairly complementary. BNPL services are heavily integrated within e-commerce platforms. With e-commerce becoming increasingly popular, it has also become more tempting for users to opt for BNPL at the click of a button. The outcome is that now e-commerce platforms have seen a large increase in sales coming from BNPL. As mentioned, the popularity of BNPL can also be attributed to the relatively lenient regulatory environment they operate in. However, with concerns about the risk of these schemes increasing, many governments around the world are starting to consider updating these regulatory frameworks. With tighter regulation, BNPL services will likely lose part of what makes them so attractive to their users, blurring the line of what makes them different to conventional credit cards. With it being less attractive, we could see a substantial decrease in the use and popularity of BNPL. This, in turn, could lead us to see a sizable decline in e-commerce transactions, essentially acting as a negative demand shock.

Regulatory outlook

The risks mentioned earlier are not new; regulators have taken notice of the huge growth in BNPL and the risks this could pose to consumers, as well as the broader economy. Up until now, the BNPL market has operated in a largely unregulated manner. However, several countries have started to consider updating the regulatory framework that these providers ought to adhere to. Though, as expected, these regulations will vary from country to country. For the sake of brevity, we will look at the regulatory outlook of the UK, the EU, and the US.

The UK: In October of last year, the HM Treasury opened a consultation on the regulation of BNPL following its explosive growth. The consultation outlined that lenders offering 'deferred payment credit' are to be authorised by the Financial Conduct Authority (FCA) and be subject to ongoing supervision (Sims, 2024). Since then, an update to the regulation has been confirmed and is expected to be enforced by July 2026. The key regulatory requirements now include: FCA authorisation, consumer duty compliance, creditworthiness assessments, and enhanced consumer disclosures (Cirignano, 2025). The goal of the new regulations is not to completely dismantle the BNPL market; rather, it aims to ensure consumers are treated fairly and transparently. The hope is that firms that act early will have an opportunity to lead the market in a responsible and sustainable manner.

The EU: Like the UK, the EU has decided to enforce new regulations for BNPL providers. Up until now, BNPL providers have been operating in a bit of a grey area that did not fall under the 2008 directive. This has been reviewed, and starting in November of 2026, BNPL providers will have to adhere to the new Consumer Credit Directive (CCD2). The new directive introduces three pillars that will affect the current business model of BNPL providers. The first is credit and affordability assessments prior to approving a transaction. This aims to prevent users from taking on debt they simply cannot handle. The second law imposes national caps on interest rates and fees that BNPL providers charge for late payments. Whilst providers do generate revenue from several sources like flat fees and merchant fees (as compensation for offering BNPL as a payment option), late fees are the main revenue driver for BNPL providers (Kidecha, 2025). As such, providers may force providers to quickly update their revenue models quite drastically. Lastly, the third rule mandates a dramatic increase in transparency. Providers will be required to present standardised pre-contractual information that outlines the costs, terms, and risks.

The goal of these new regulations is to protect consumers from taking on more debt than they can manage. However, there has been discussion regarding the potential for traditional banks to enter a market that has been dominated by Fintech firms up until now. The costs of compliance will be high for current providers as they scramble to adjust to new regulatory frameworks. This opens the door for banks that have much more experience in credit assessment and established frameworks that comply with regulations. With this in mind, it is possible that these banks will now be able to provide more competitive offerings and increase their market presence.

The US: Unlike the UK and EU, which are moving with dedicated BNPL frameworks, the US has taken a more fragmented path. The US has already started to see some cracks with BNPL borrowers defaulting on 2% of their loans, though this is still much lower than defaults on credit cards, which stand closer to 10%. This has led to the Consumer Financial Protection Bureau (CFPB) coming under scrutiny for failing to enforce stricter regulations (TTP, 2025). The CFPB has issued reports and an interpretive rule that effectively treats certain BNPL accounts as credit cards under existing Truth in Lending rules (CFPB, 2024). This wouldn't treat BNPL accounts exactly like credit cards, but would mean providers have to issue periodic statements and give clearer cost-of-credit disclosures. However, earlier this year, it was announced that the CFPB would not issue this revised BNPL rule, leaving the long-term regulatory direction rather uncertain. In the meantime, States like California and New York have stepped in with their own licensing and consumer-protection regimes (Dhyani, 2022; Pearson & Mitzenmacher, 2025). This has created a patchwork of rules to abide by for BNPL providers in the US.

Conclusion

The popularity and adoption of BNPL services have skyrocketed in recent years, and there are several factors that could explain this growth. For one, these services have innovated how easily individuals can access credit. Additionally, BNPL has become increasingly integrated into payment mechanisms, now becoming accessible on e-commerce websites, apps, and physical stores at the tap of a button. This has been especially beneficial given the substantial growth e-commerce transactions have experienced. Lastly, BNPL providers have enjoyed a relatively relaxed regulatory environment that has allowed them to provide credit without adhering to the rules other, more traditional, credit providers have to adhere to.

However, this convenience does come at a cost. Its integration across different means of payment has incentivised overconsumption by constructing an illusion of affordability. Large one-off payments that would seem justifiable have quickly morphed into everyday transactions like groceries. Users are then left with large amounts of accumulated debt that may exceed what they are able to afford. The real issue is that many users are not even aware of the fees that can be charged for late payments prior to opting for BNPL. In fact, it is this misconception that allows BNPL providers to stay afloat. BNPL also has the potential to distort credit markets, as creditors may now have a harder time assessing the creditworthiness of individuals. Credit scores are useful metrics that aim to capture credit behaviour itself for credit card users. However, for BNPL users, the only observable behaviour is defaults.

The future of the BNPL market is somewhat uncertain, but it is likely to face a contraction. Its growth is largely reliant on lenient regulations. The US market is especially valuable, and this is an area where the current regulatory landscape is favourable for BNPL providers. But it is unknown whether this will continue, or for how long. What is more certain is that areas that will see stricter regulation are likely to experience a decrease in the popularity of BNPL. The stricter regulations in places like the UK and EU will force BNPL providers to change their business models and leave the door open for more traditional banks to enter the market that has been dominated by fintech firms up until now.

Work Cited

CFPB. (2024a, May 22). CFPB takes action to ensure consumers can dispute charges and obtain refunds on buy now, pay later loans. Consumer Financial Protection Bureau. https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-to-ensure-consumers-can-dispute-charges-and-obtain-refunds-on-buy-now-pay-later-loans/

CFPB. (2024b, August 30). What happens if I can’t pay back a buy now, pay later (BNPL) loan? Consumer Financial Protection Bureau. https://www.consumerfinance.gov/ask-cfpb/what-happens-if-i-cant-pay-back-a-buy-now-pay-later-bnpl-loan-en-2116/#:~:text=Your%20missed%20payments%20may%20lead,and%20hurt%20your%20credit%20scores.

Cirignano, S. (2025, July 23). BNPL regulation: FCA Tightens Oversight. Avyse Partners. https://www.avyse.co.uk/insights/bnpl-regulation-what-firms-need-to-know#:~:text=BNPL%20has%20become%20a%20mainstream,value%2C%20interest%2Dfree%20credit.

Dhyani, J. (2022, September 15). California settlement offers reminder that buy now pay later participants are subject to California Financing Law. Of Interest. https://www.alstonconsumerfinance.com/california-settlement-offers-reminder-that-buy-now-pay-later-participants-are-subject-to-california-financing-law/

Half of the BNPL users unaware of late payment fees. bobsguide. (2025, January 17). https://www.bobsguide.com/half-of-the-bnpl-users-unaware-of-late-payment-fees/

Kidecha, S. (2025, September 9). Buy now pay later business model: How does it work?. Kody Technolab. https://kodytechnolab.com/blog/buy-now-pay-later-business-model/

Klarna. (2025, July 22). Klarna pay in 4 agreement. https://cdn.klarna.com/1.0/shared/content/legal/terms/0/en_us/sliceitinx

Lopatto, E. (2024, January 24). Klarna will now let you pay them so you can pay them less money. The Verge. https://www.theverge.com/2024/1/24/24049445/klarna-plus-bnpl-consumer-debt-ipo

Martino, P., Petrova, E., Havard , A., & Castagnino, E. (n.d.). Reinventing consumer finance: Buy Now, Pay Later encourages banks to transform. Deloitte. https://www.deloitte.com/lu/en/Industries/banking-capital-markets/perspectives/buy-now-pay-later-encourages-banks-transformation.html

Medine, T. (2023, January 4). Can you have multiple BNPL accounts at once?. Experian. https://www.experian.com/blogs/ask-experian/can-you-have-multiple-buy-now-pay-later-accounts/#:~:text=In%20reviewing%20the%20eligibility%20requirements,provider%20depends%20on%20the%20company.

Morgan Stanley. (2025, June 9). BNPL: Fast growth and new behavior. https://www.morganstanley.com/insights/articles/buy-now-pay-later-trends-2025

Pearson, D., & Mitzenmacher, E. (2025, June 6). New York Enacts First-of-Its-Kind Law to License Buy-Now-Pay-Later Lenders. Insights | Mayer Brown. https://www.mayerbrown.com/en/insights/publications/2025/06/new-york-enacts-first-of-its-kind-law-to-license-buy-now-pay-later-lenders

Sims, E. (2024, November 26). The rise of buy now pay later and regulatory horizon. RSM UK. https://www.rsmuk.com/insights/advisory/the-rise-of-buy-now-pay-later-and-regulatory-horizon

TTP. (2025, July 20). The BNPL time bomb: How “Buy Now, Pay Later” is rewiring American debt. Trade Treasury Payments. https://tradetreasurypayments.com/articles/the-bnpl-time-bomb-how-buy-now-pay-later-is-rewiring-american-debt

Udavant, S. (2025, October 8). Buy now, pay later (BNPL): What it is, how it works, Pros and Cons. Investopedia. https://www.investopedia.com/buy-now-pay-later-5182291

Yahoo! (2025, November 10). Digital Payment Update - future trends shaping the digital wallet ecosystem. Yahoo! Finance. https://finance.yahoo.com/news/digital-payment-future-trends-shaping-123808865.html